Montana offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Montana Renewable Energy Association

NorthWestern Energy Rebates and Incentives

Yellowstone Valley Electric Cooperative

Montana-Dakota Utilities Co.

Flathead Electric Cooperative

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Montana State Capitol

1301 E 6th Ave,

Helena, MT 59601

Phone: (406) 444-2511

Fax: (406) 444-2701

Hours: M-F 8:00am – 5:00pm

S-S 9:00am – 3:00pm

NorthWestern Energy

Helena Division Office

1313 North Last Chance Gulch

Helena, Montana 59604

(888) 467-2669

Hours: M-F 7:00am – 6:00pm

Montana Department of Environmental Quality

1520 E 6th Avenue

Helena, MT 59601

(406) 444-2544

[email protected]

Hours: M-F 8:00am – 5:00pm

Billings Weather Bureau

2170 Overland Ave

Billings, MT 59102-6455

(406) 652-0851

[email protected]

Hours: Open Dialy, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Alternative Energy Systems Income Tax Credit | 100% up to a maximum of $500 | Individuals individuals who have installed a new alternative energy system in their primary dwelling |

| Energy Conservation Tax Credit | 25% of the cost of labor and materials for eligible home improvements | Individuals who made home improvements to existing and new homes |

| Geothermal Systems Income Tax Credit | $1,500 per installation | Individuals who have installed a new geothermal energy system or ground source heat pump for heating or cooling |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

NorthWestern Energy

Account Services

Billing & Payment

Clean Energy

Safety Resources

Tax Credits & Other Resources

Ways to Save

Montana Clean Energy Tax Credits

Net Energy Metering

Power Outage Map

Montana Department of Commerce

Phone: (406) 841-2700

Monday – Friday

9 AM – 5 PM

301 S Park Ave,

Helena, MT 59620

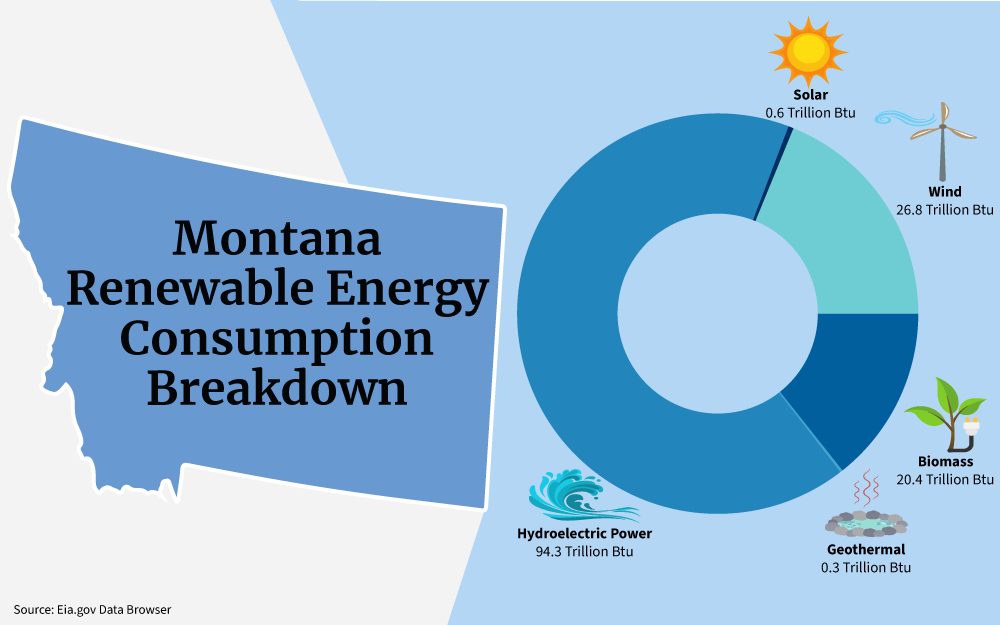

One reason loan and grant programs exist as part of the Montana solar incentives is they involve an investment in renewable energy for the state.1 In fact, solar options are increasingly feasible in Big Sky Country, and nationwide.

Overview of Solar Energy in Montana

Solar is 90 percent more affordable than it was in 2009.2 The cost-effectiveness and solar energy efficiency make investing in solar a highly valuable option.

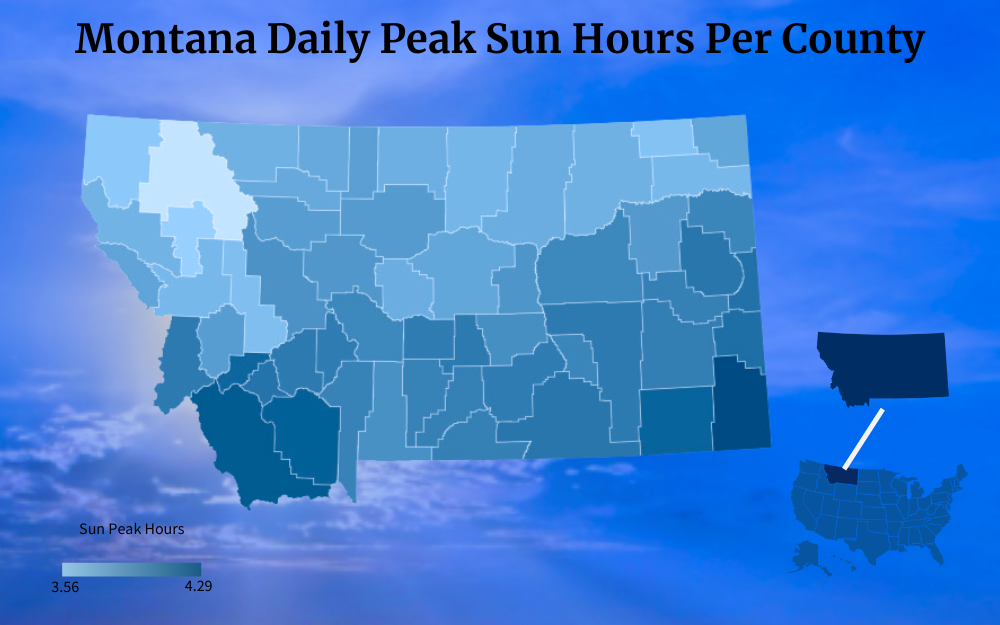

Montana is an ideal state for solar energy implementation and optimization. Many residents work in agricultural settings and are commonly independent of grid-based utilities, making Montana solar incentives a big help to those who need to establish home solar energy systems.

Solar transitions facilitate convenient, cost-effective, reliable energy. They can also expand property value.

Montana ranks only 40th in the nation for solar adoption, but this guide details the incentives that are available for Montana residents interested in making this renewable investment and lowering their household energy emissions.

In addition to outlining the steps to apply for solar loans in Montana, it include the steps for enrolling in the state solar tax credit, obtain rebates from renewable energy programs, and how to calculate potential value from a solar upgrade.

What Solar Credits Are Available in Montana?

Tax credits, grants, loans, rebates, and net metering represent primary solar benefits in Big Sky Country. The Alternative Energy Revolving Loan Program (AERLP) helps residents install solar through low-interest loans.

Home equity increases through solar without impacting property taxes, and there is room to see a return on solar investment statewide. However, these Montana solar incentives do not equate to government solar panels free of charge.

This section briefly examines all state-centered solar options, application criteria, and what paperwork is necessary for eligibility.

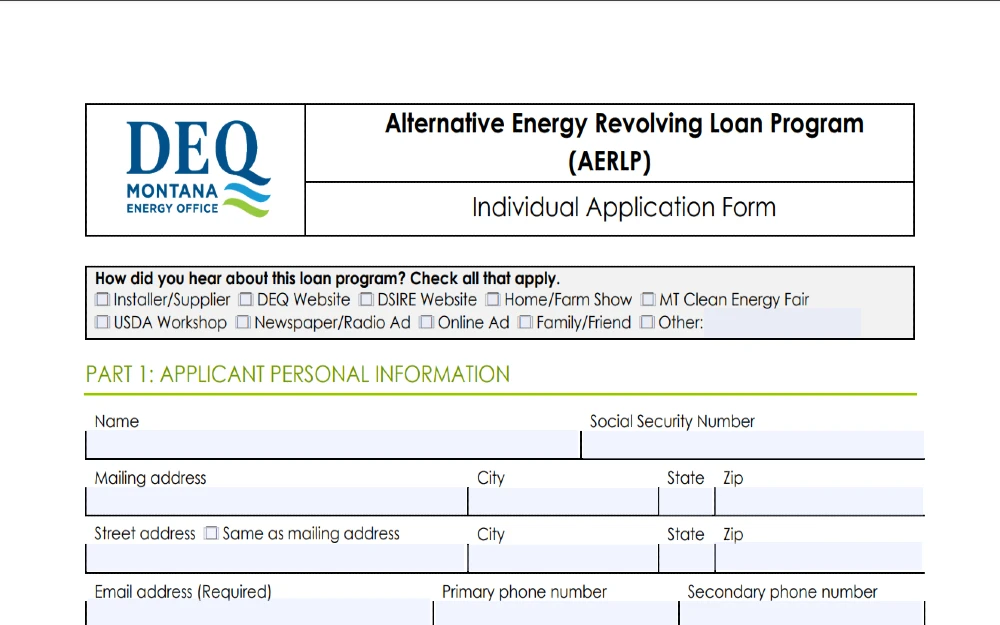

The AERLP

One goal of the Alternative Energy Revolving Loan Program is to encourage investors to explore renewable energy. This low-interest loan option has been around for 22 years.3

Over $17,000,000 has been invested in varying alternative energy systems via AERLP. In 2023, interest is fixed at 3.5% with an APR of 4.023%.

Those terms are for a loan at $25,000 over a 10-year term. Closing costs would be $625.

To apply, contact AERLP. It’s expected there’ll be a high demand for funding this season.

Loan approval is subject to ranking. Said ranking consists of five steps: application, technical review, financial review, scoring queue, and potential funding.

How well you “score” determines if you’ll be given a loan. (Such loans may be higher or lower than the $25,000 assumed here to demonstrate interest and closing costs.)

Those wishing to apply will do best if they present a well-considered application that squarely demonstrates financial capability.4 You’ll need to contact the DEQ, or the Department of Environmental Quality, to acquire loan packets and other information on this year’s prerequisites for documentation.

Reviews take place throughout the year.

Montana Rebate Opportunities

State-sponsored rebates aren’t available in Montana. However, there are over 20 MT solar companies,5 and their numbers continue to grow.

Check with all providers across the state for rebates, coupons, or other deals accompanying solar installation.

How Net Metering Works in Montana

Net Metering in Montana is available for systems designed to be no larger than 50 kilowatts (KW) in size through Montana Dakota Utilities (MDU) and NorthWestern Energy (NWE).6 Other utility providers offer net metering at thresholds between 10 KW and 50 KW.

All Montana net metering provides 100% delivery, returning the total price per kilowatt of energy produced by a given solar array. Solar arrays of multiple customers cannot be combined.

Such opportunities are legally protected until solar energy becomes 5% of total state energy production. Presently solar represents 1% of total MT energy, meaning those with solar will enjoy net metering benefits for years to come.

To apply, simply contact whatever energy company you already work with. MDU and NWE provide the best deals presently.

One last point: watch for the surplus contingency. If you’re running a surplus for a straight year,7 the companies won’t provide net metering benefits.

Be savvy with your array and you can run it 11 months at a surplus.

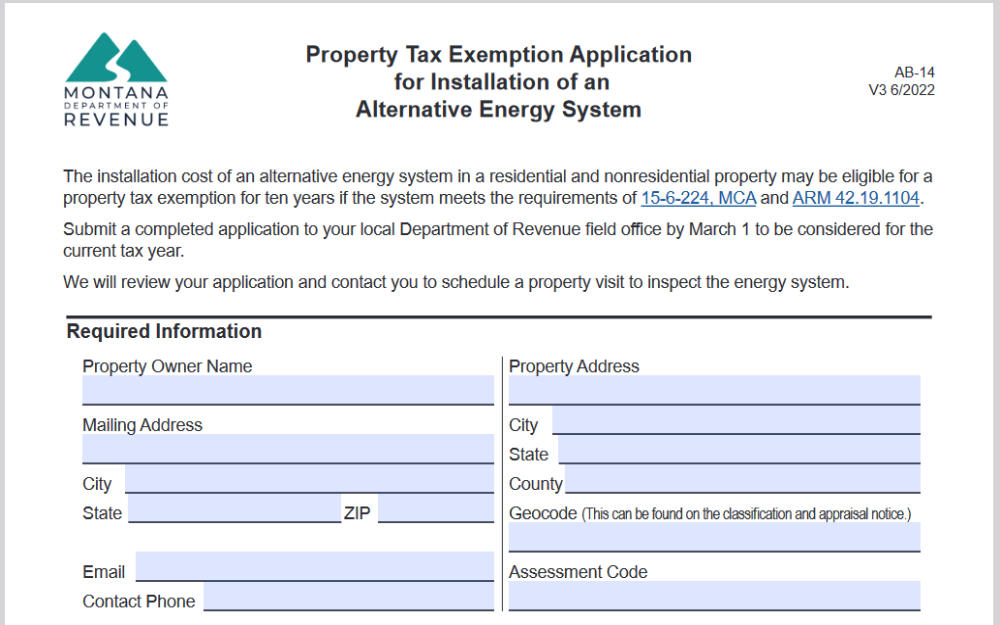

Expanded Equity Through Solar Tax Exemptions

MT property assessors won’t factor solar energy into tax assessment for ten years, and up to either $20,000 or $100,000 depending on the property.8 Single-family homes qualify for a $20,000 exemption, and multiple-family homes get the $100,000 exemption.

Non-residential structures also qualify for a $100,000 exemption. All that’s required to qualify is an initial application.9

The form you need to complete can be found on the Montana Department of Revenue’s website.10

Renewable Solar Energy Credits From the Government

EERE, the Office of Energy Efficiency and Renewable Energy,11 offers individual solar users credits through the ITC.

For larger businesses or expansive individual interests, PTC offers credits per kilowatts. We’ll look at both.

The Ins and Outs of the ITC

The federal Investment Tax Credit, or ITC, is available to any home that installed a solar array between 2017 and 2034. You can claim 30% of that solar array as a credit for the tax year in which the array was installed.12

To qualify, a residence has to be in the United States. You either have to own it, or you have to be able to prove you purchased an interest or share in what’s defined as an “off-site community solar project.”13

Credit is only possible on “original installation”, meaning you can’t claim it for maintenance, repair, or replacement later. You can claim it for panels, equipment involved in connecting those panels, installation bills, sales tax, and batteries.

Once you know all costs, properly express them in a form 5695.14 Include the 5695 with your 1040 or other tax information for the year.

How the Production Tax Credit (PTC) Works

The Production Tax Credit may be available for smaller photovoltaic solar energy systems, but it’s only a true “incentive” for larger installations. Basically, you get a tax credit per kilowatt produced.

PTC-eligible properties need to be under US jurisdiction (either in one of the states or a US territory), and use new equipment (or used solar panels that are newly installed). Panels can’t be leased to an entity that is “tax-exempt”, like a school.15

Those who qualify receive a base “credit” per kilowatt-hour (kWh). That credit is available for a decade.

Projects starting before 2033 get 2.75 cents per kWh.16

A property that averages 1,000 kWh a month would get $330 a year in tax credit. If your solar installation produces 10 megawatt-hours (MWh) a month, that’s 10,000 kWh, and worth a $3,300 tax credit.

So 100 MWh would pull in a $33,000 tax credit, and 1,000 MWh would be $330,000 in tax credits.

There’s an 80 MW installation near Billings.17 Solar arrays produce at or over four times the kilowatts of an array;18 at least in terms of daily production.

A 10 KW system would produce 40 kWh daily. An 80 MW installation should produce 320 MWh a day, or 116,800 MWh a year.

Under PTC, an ideal production at this magnitude would yield $3,212,000 in tax credits. That will fluctuate annually but lasts a decade.

For organizations interested and eligible, simply include a form 8962 with annual tax documentation.19

How Can I Sell Power to Montana?

In Montana, a PPA, or Power Purchase Agreement allows you the option of selling solar power to generate income.30 Net metering is a form of PPA.

Such PPA options can provide over $600 a year with a proper system.

The only caveat is you’ll need to produce in excess of need 11 months a year. If you do so for 12, utility companies won’t honor said excess anymore.

How To Apply for Solar Credits and Rebates in Montana

There aren’t government rebates in Montana, but solar companies have options, so discuss rebates with specific solar providers offering installation.

For solar credits, the only option available in MT outside net metering is the federal ITC. Include an IRS Form 5695 with your 1040 or other tax documentation to apply.

Here are the steps to apply for federal ITC:

Step 1. Gather your solar installation invoices: You’ll need these to determine the total cost that is eligible for the tax credit.

Step 2. Locate and download form 5695: You can find form 5695 on the IRS website.

Step 3. Fill out the form: Using your collected invoices and financial records, complete IRS form 5695 according to its guidelines to determine your eligible credit amount.

Step 4. Attach to your tax return: Once you have filled out form 5695, attach it to your IRS form 1040. Make sure to check the appropriate box on your tax return to indicate you are claiming an energy credit.

For PTC aimed at large solar arrangements, include an IRS form 8962 with tax information.

How Long Do Solar Credits Last in Montana?

Montana does not offer a state-specific solar tax credit, so the question “how long do solar credits last in Montana?” is primarily applicable to federal incentives like the Investment Tax Credit (ITC).

The absence of state solar tax incentives might be the reason for the solar capacity in Montana.

Can I Get Solar Credits in More Than One State?

The question “can I get solar credits in more than one state?” can be answered affirmatively. You have the potential to qualify for solar credits in several states if you have installations in each and satisfy the individual eligibility requirements of those states.

How Much Does It Cost for Solar Power Systems?

Professional solar installation for solar energy in Montana is approximately $2.54 per Watt,20 covering the lifespan of solar panels and other necessary components. The installation package typically includes solar board, also known as solar panels made of specific solar panel materials, along with surge protectors, power inverters, cords to connect solar panels to surge controllers, cords to connect surge controllers to batteries, mounts for solar panels, and varying other equipment to transfer energy from panels to property owners.

So a 10 KW array is 10,000 Watts multiplied by $2.54. That comes out to $25,400.

To determine exact costs, consider average energy usage. A 10 KW array produces 40 kWh or more a day, on average.

Monthly, that’s 1,200 kWh or more; or 14,400 KW a year. Call it 14.4 MW a year; about one and a half times the average use of Montana residents at 9.48 MW.21

A solar array that reflects the average would require 9,480 kWh, or 790 a month. That’s 25.97 kWh a day if you divide 365 into 9,480.

You would need a 6.5 kWh system to match the average energy use in Big Sky Country.

A 6.5 kWh array would cost $16,510 before tax credits or incentives in MT. If you go the Do It Yourself, or DIY, route, all the equipment can be acquired for between $1 and $1.50 per Watt, on average (but you need a pro electrician to install if you want to take advantage of net metering benefits).22

Some kits can be bought at brick-and-mortar stores, others must be shipped in. If you’re interested in how to make solar panels, various resources and kits can guide you.

The baseline on average arrays in Montana is $6,500 to $9,750.

The big consideration is Montana’s winter. Weeks can go by at subzero.

Solar energy needs to be robust enough to provide green electricity or be supplemented with secondary energy options. With proper batteries and a large enough array, winters are no issue, although you may experience a slight dip in solar production during those months.

That’s a good reason to double the size of your array. Though the average cost should be in the neighborhood of $6,500 to $16,510, depending on if you go the DIY route or not, spending $10,000 to $25,400 for a 10 KW array will definitely serve your needs annually.

Whether you work with pros or install yourself will be the largest indicator of the true cost of solar power installed.

Solar Calculator: How Much Can You Save in Montana on Solar Energy Systems?

It’s possible to see total investment in solar returned within a decade, but you’ll want to plan carefully and take full advantage of all available Montana solar incentives. Montana doesn’t have sales tax,23 so you’ll save automatically.

However, consider the roof area required for installation and ask, “If a roof replacement is required, is that covered by the tax credit?” to fully understand your financial commitment.

Figure solar space at one square foot for 20 Watts, and add a 33% “cushion” to account for differing panel brands. A 10 KW array needs 500 to 750 square feet and would include 33 solar modules at 300 Watts, and 1 panel at 100 Watts.

Average panels are 3 by 5 feet or 39 by 65 inches. There’s plenty of variance there.

Where you mount panels won’t add much additional expense, but it’s especially considerable when you factor in maintenance.

Other factors to consider include:

- The ITC option

- The 10-year equity tax exemption

- Net metering

- AERLP loans and grants

- Deferred utility expenses

The ITC Option

For a 10 KW solar array that’s $25,400, you can claim $7,620 in federal tax credits. The 22% tax bracket represents most Montana residents,24 as the average earner makes $82,237 a year.25

You can subtract $7,620 from that sum if you attach an ITC tax form with associated documentation after you install an array.

For an average individual, that would lower tax liability to $74,617. If you paid the average amount, prior to other deductions, you’d have up to $18,092.14.

With the ITC credit, that drops to $16,415.74, or a savings of $1,676.40. Savings become even more dramatic if you’re on the edge of a tax bracket.

Heads of households who made, say, $65,000 in a year will drop below the $59,000 threshold for the 22% tax bracket.

If you made $65,000 as the head of a household after all deductions, that’s $14,300 for which you’re liable. If you installed a 10 KW solar array, you’re at $57,380, which is in the 12% bracket for heads of household.

Now you’re at $6,885.60. That means you’ve saved $7,414.40.

If you’re careful in filing taxes the year you install panels, on average, you’ll save at least $1,676.40 in MT; so that’s the number used here. However, you could save much more should you be on the edge of a bracket.

The 10-Year Equity Tax Exemption

The average property tax rate in Montana is .0083%,26 or $830 for every $100,000. Solar arrays bring approximately 4.1% in terms of additional property value, and average homes in Montana are valued at $440,339 as of May, 2023.27

That would come out to an increase in property value of $18,053.899. For simplicity’s sake, this is rounded up to $18,053.90.

Now your home is worth $458,392.90. Without the exemption, your home would have $3,804.66 in taxes a year.

With the exemption, you only pay $3,654.81 for an average annual savings of $149.85, or $1,498.50 in ten years.

Net Metering

MT net metering pays 100% of the value a utility company associates with a kilowatt. In Montana, across the many utility companies out there, the average value per KW is 12.82 cents.28

So 9.48 MW a year indicates an annual cost to Montana residents of $1,215.336, which is best rounded up to $1,215.34. A solar array at 10 KW would average 14.6 MW a year.

If usage were average, that would be 5.12 MW of excess; or, ideally, $656.38 a year in net metering credits. Winter will likely extract a large amount from such excess.

As discussed earlier, you can’t be productive for 12 straight months and still receive net metering in Montana.

5.12 MW divided by twelve indicates maximum potential, and that’s what is considered here. However, if you want to do net metering continuously, you’ll have to subtract one month from the final sum.

In light of that, potentially, every year you could see up to $601.58 in net metering for a 10 KW system.

AERLP Loans and Grants

This is a variable quantity, but if you qualify, it’s worth factoring in. The loan average of $25,000 at a fixed 3.5% interest rate over a ten-year term would represent a monthly cost of $247.21.

For a $25,400 loan, that’s $251.17.29 An average Montana household is paying $1,215.34 a year for electricity, or $101.27 a month.

With this Montana solar incentive, you’d erase your utility bill and have a loan payment that’s double the amount.

When the loan expires, your residential solar system is purely productive. This will vary, so it’s only included here for reference.

Since approval is based on rank, this isn’t something everyone can use.

Deferred Utility Expenses

Average annual utilities for MT residents are $1,215.34 at 12.82 cents per KW. You can only claim net metering credits for 11 months of the year.

Even so, there may be better savings from simply supplementing grid-based electric costs. $1,215.34 becomes $12,253.40 in ten years.

Solar can help you save that much on traditional utilities.

All Variables Considered Together

For a $25,400 baseline prior incentives on a 10 KW array, full available Montana solar incentives can help you save the following amounts:

- Average ITC Savings: $1,676.40 in the year you install.

- Average Equity Tax Savings: $149.85 per year, $1,498.50 after 10.

- Full Net Metering Potential: $601.58, $6,015.80 in after 10.

- Deferred Utility Expenses: $1,215.34, or $12,153.40 after 10.

With these incentives, you can subtract $3,643.17 from the final costs in the first year you install. Your out-of-pocket expense will be $21,756.83 on an average 10 KW system.

In ten years, you’ll be looking at a total cost of $5,732.30. However, you will see an average equity increase on your property of $18,053.90.

By the end of ten years with a 10 KW array, you should be looking at a net worth increase of $12,321.60.

From that point, you’re free of utility-based grid expenses and you retain equity. Expect to increase net worth by $102.68 a month over the course of 10 years.

It’s like replacing a monthly electricity bill for an equity bonus that’s just a bit higher.

How To Choose Solar Panels in MT

With 28 total companies offering solar in Montana, and 20 offering installation, determining who offers the best deal requires figuring out your needs and budget. We’ve helped provide an idea of what needs and budget will have to be for the solar energy you can rely on annually.

Plug in your own unique variables for greater accuracy.

Provide your projection to whichever salesman you contact, then contact every single company to determine your options. All have advantages and disadvantages, some certainly have competitive ways of promoting their services over rivals.

Explore reviews online to see what locals are saying. If you can find the time, interview existing customers to get an idea of what they like, what they don’t like, and what they would do differently.

An array of 10 KW should cost $25,400 or less in total, which breaks down to $2.54 a Watt; the average regardless an array’s size. If costs are higher, carefully determine why, and if the increase is worth it.

Solar energy in Montana can pay for itself within a decade with enough power to keep your property energized during winter. However, you should install a robust array, and be diligent to pursue incentives.

You should see equity enhancement. For a smaller array, investment return comes faster, but you want to be sure what you install matches your real needs.

The best way to do this is to calculate monthly needs using the most electric-intensive month as a “low” watermark. Plan for a long-term investment.

Be careful to maintain your solar panels by regular cleaning. Many MT companies offer solar maintenance.

Over ten years, expect to expand your net worth and equity in Montana by the cost of your monthly electric bill with the help of Montana solar incentives.

Frequently Asked Questions About Montana Solar Incentives

Can Solar Energy Be Used "Off the Grid" in Montana?

Solar arrays can be installed “off the grid”, and with many agricultural installations in remote regions of the state, this is desirable.

Will Solar Energy Provide Electricity Through Montana's Winters?

Solar energy can and will provide energy through winter in Montana, but the array has to be robust, and installed where you can clean panels should obstructive snow become an issue.31

When Is the Best Time To Install Solar Energy in Montana?

Install in late April or early May. Alternatively, Autumn installation should be mid to late September.

References

1US Department of Energy. (2022, November 4). State and Community Energy Programs Project Map – Montana. Energy.gov. Retrieved September 11, 2023, from <https://www.energy.gov/scep/articles/state-and-community-energy-programs-project-map-montana>

2Scheltens, L. (2023, April 13). How solar energy got so cheap. Vox. Retrieved September 11, 2023, from <https://www.vox.com/videos/23682054/solar-policy-cost-us-germany-china>

3State of Montana. (2023). Alternative Energy Revolving Loan Program. Montana DEQ. Retrieved September 11, 2023, from <https://deq.mt.gov/energy/Programs/AERLP>

4Montana Energy Office. (2022, October). Alternative Energy Revolving Loan Program. Montana Energy Office. Retrieved September 11, 2023, from <https://deq.mt.gov/files/Energy/Documents/AERLP/AERLP_Ranking_Criteria_03242023.pdf>

5Simms, D. (2023, September 4). Top 5 Best Solar Companies in Montana (2023 Reviews). Eco Watch. Retrieved September 11, 2023, from <https://www.ecowatch.com/solar/best-companies/mt>

6Brouwer, B. (2023, April 17). Montana Community-Scale Solar Strategy Project (Final Technical Report). Osti.gov. Retrieved September 11, 2023, from <https://www.osti.gov/servlets/purl/1630438>

7Solar Reviews. (2023). Summary of Montana solar incentives 2023. solarreviews.com. Retrieved September 11, 2023, from <https://www.solarreviews.com/solar-incentives/montana>

8State of Montana. (2022). Montana Code Annotated 2021. Montana Legislature. Retrieved September 11, 2023, from <https://leg.mt.gov/bills/mca/title_0150/chapter_0060/part_0020/section_0240/0150-0060-0020-0240.html>

9Lincoln Institute of Land Policy. (2023). Property Tax Exemption for Buildings Using Renewable Energy. Lincoln Institute of Land Policy. Retrieved September 11, 2023, from <https://www.lincolninst.edu/incentive-specific-property/property-tax-exemption-buildings-using-renewable-energy-montana-2020>

10Montana Department of Revenue. (2022, December 13). Property Tax Exemption Application for Installation of an Alternative Energy System (Form AB-14). Montana Department of Revenue. Retrieved September 11, 2023, from <https://mtrevenue.gov/publications/application-for-tax-incentive-assessment-of-energy-generating-property-form-ab-14/>

11Energy Efficiency & Renewable Energy. (2023). Energy Efficiency & Renewable Energy Website Homepage. Department of Energy. Retrieved September 11, 2023, from <https://www.energy.gov/eere/office-energy-efficiency-renewable-energy>

12Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Department of Energy. Retrieved September 11, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

13Internal Revenue Service. (2015, July 28). CC:PSI:B6 PLR-111860-15. Internal Revenue Service. Retrieved September 11, 2023, from <https://www.irs.gov/pub/irs-wd/201536017.pdf>

14Internal Revenue Service. (2023). Residential Energy Credits Form 5695. IRS. Retrieved September 11, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

15Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Department of Energy. Retrieved September 11, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

16Boston Solar. (2023, May 17). The Basics of the ITC vs. PTC for Commercial Solar Installation. Boston Solar. Retrieved September 11, 2023, from <https://www.bostonsolar.us/solar-blog-resource-center/blog/the-basics-of-the-itc-vs-ptc-for-commercial-solar-installation/>

17U.S. Energy Information Administration. (2023, April 20). Profile Analysis. U.S. Energy Information Administration. Retrieved September 11, 2023, from <https://www.eia.gov/state/analysis.php?sid=MT>

18Zagame, K. (2023, August 9). How Much Does a 10kW Solar System Cost? Eco Watch. Retrieved September 11, 2023, from <https://www.ecowatch.com/solar/10kw-solar-systems>

19Internal Revenue Service. (2022). 2022 Instructions for Form 8962. IRS. Retrieved September 11, 2023, from <https://www.irs.gov/pub/irs-pdf/i8962.pdf>

20Neumeister, K. (2023, September 4). How Much Do Solar Panels Cost in Montana? (2023 Savings Guide). Eco Watch. Retrieved September 11, 2023, from <https://www.ecowatch.com/solar/panel-cost/mt>

21Find Energy LLC. (2023, August 24). Electricity Rates in Montana. Find Energy. Retrieved September 11, 2023, from <https://findenergy.com/mt/>

22Hyder, Z. (2023, January 12). DIY solar panels: Pros, cons & 6-step cost savings guide. Solar Reviews. Retrieved September 11, 2023, from <https://www.solarreviews.com/blog/pros-and-cons-of-buying-diy-solar-panels>

23Avalara, Inc. (2023). Montana sales tax rates updated monthly. Avalara. Retrieved September 11, 2023, from <https://www.avalara.com/taxrates/en/state-rates/montana.html>

24Parys, S., & Orem, T. (2023, August 2). 2022-2023 Tax Brackets and Federal Income Tax Rates. Nerd Wallet. Retrieved September 11, 2023, from <https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets>

25Point2. (2023). Montana Demographics. Point2. Retrieved September 11, 2023, from <https://www.point2homes.com/US/Neighborhood/MT-Demographics.html>

26Beagle Financial Services, Inc. (2023). How is Montana for Retirement? Meet Beagle. Retrieved September 11, 2023, from <https://meetbeagle.com/resources/post/how-is-montana-for-retirement>

27Corliss, C. (2023, May 30). The State of Solar Energy in Montana. Purelight Power. Retrieved September 11, 2023, from <https://purelightpower.com/blog/montana/solar-energy-in-montana/>

28US Energy Information Administration. (2023, April 20). Montana State Energy Profile. US EIA. Retrieved September 11, 2023, from <https://www.eia.gov/state/print.php?sid=MT>

29Bankrate, LCC. (2023). Annual Percentage Rate Loan Calculator. Bankrate. Retrieved September 11, 2023, from <https://www.bankrate.com/loans/personal-loans/annual-percentage-rate-calculator/>

30Better Buildings. (2023). What is a Power Purchase Agreement? Better Buildings. Retrieved September 11, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

31Valainis, A. (2020, October 22). Solar and Snow: To Brush or Not to Brush. Montana Renewable Energy Association. Retrieved September 11, 2023, from <https://montanarenewables.org/education-and-information/solar-and-snow/>

32Screenshot from Montana Department of Revenue. MTRevenue.gov. Retrieved from <https://mtrevenue.gov/wp-content/uploads/mdocs/ab-14%20property%20tax%20exemption%20application%20for%20installation%20of%20an%20alternative%20energy%20system.pdf>